Serving San Diego Homeowners Since 2006

Menu

Reasons to Sell Your House in San Diego in 2021

Despite the challenges of 2020, it was a great year to sell your house in San Diego. In 2020 and 2021, the median San Diego home price rose 20%. These numbers have accelerated a decade-long trend of growth in the San Diego housing market. While this is ultimately great news for San Diego homeowners, there are reasons to believe this rate of growth might be slowing or even reversing. For several reasons, 2021 might be the year you might want to sell your house in San Diego. Here are some factors for San Diego homeowners to monitor in the coming months.

Why has the San Diego housing market been so strong?

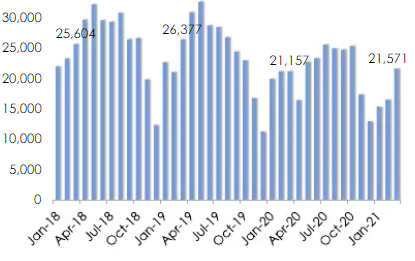

San Diego has always been a desirable location for home-buyers across the state and country this has always kept the demand for San Diego property stable. In contrast, there has also been an unprecedented low amount of supply that has not affected demand for San Diego housing. This imbalance in supply vs. demand, packaged with traditional factors like location and inflation, prices throughout the county have risen benefitting all San Diego homeowners who try to sell their house.

With all this said there are several reasons to believe we are approaching the end of this trend. While we aren’t going to go as far as to predict a crash, there is reason to believe prices may drop sometime shortly. Here are some factors to consider. Take a look and keep these points in mind if you want to sell your San Diego home.

Government policy and housing prices

Changes in government policy may contribute to changes in San Diego housing prices. Among other policies, the most notable are interest rates and infrastructure legislation.

Interest Rates

Interest rates fell to record lows at the beginning of 2020 during the onset of the COVID-19 pandemic. But rates are on the rise! While they remain low relative to historical timelines, they are expected to continue to rise. As interest rates continue to rise, more buyers will either leave the market or lower their budgets. Interest rates will inevitably affect home values in San Diego and beyond.

Infrastructure Bill

To combat low housing infrastructure nationwide, the Biden administration has proposed a robust budget for new housing construction across the nation, including San Diego. While no bill has passed yet, it shows the government’s commitment to creating more housing. Approval of any infrastructure bill would increase available housing, changing the supply-demand ratio and lower prices.

Eviction Moratoriums

Investment rentals have been a popular tactic used by San Diegans for years. Eviction moratoriums have driven many landlords to sell their properties rather than deal with the hassles of property management. Landlords selling their properties will continue to inject more opportunities for buyers which will give them more leverage during deal negotiations.

Government policy and housing prices

As COVID-19 cases continue to decline and restrictions continue to loosen, we expect to see an uptick in people moving and selling their homes. As people feel safe to show their homes and gain confidence in the market, we will see more San Diego homes on the market which will affect supply and prices alike. Additionally, many tech employees who migrated to San Diego during COVID are returning to their full-time offices.

Learn more about COVID safety during showings in California HERE.

Learn more about COVID safety during showings in California HERE.

California exodus in 2021 and beyond

For the first time in decades, the state of California saw its population decline year over year. As the cost of living across the state continues to rise, more people are selling their property and downsizing in cheaper states. COVID-19 slowed this trend, but with reopening looming, it will quickly ramp back up.

With more people set to leave California and San Diego, more homes will hit the market. If the ‘California exodus’ trend continues, this could seriously impact home values for San Diego homeowners across the county.

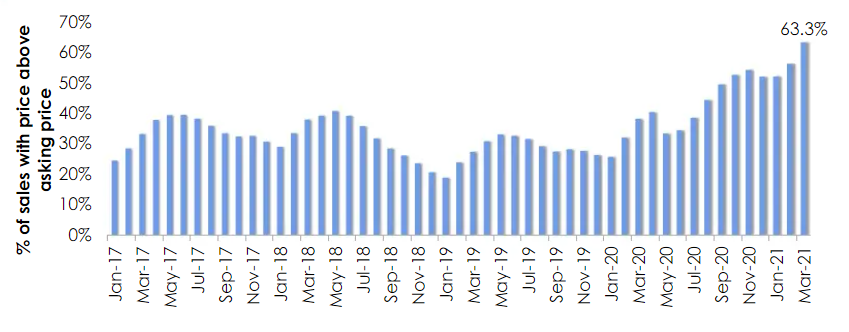

Buyer fatigue in the San Diego market

Beyond all the other factors mentioned, many buyers have given up on the market. The growth of the San Diego housing market has forced home buyers to sacrifice more and more if they hope to be able to purchase a home. There is reason to believe that these market conditions have finally pushed San Diego home buyers to the brink. This is arguably the best indicator that the San Diego housing market prices have peaked.

If buyers simply refuse to match rising prices then housing prices will drop. Given the fact that San Diego housing prices have risen year over year since 2011, it’s reasonable to think a natural price reduction is due.

When should you sell your house in San Diego?

There are many factors to consider when considering if you should sell your house in San Diego. If you are considering selling your house or property in San Diego, it really might be best to cash in sooner than later. With the market still high, San Diego homeowners have several good options for selling their homes. If you are indeed thinking about selling your home in San Diego, you should reach out to a trusted San Diego real estate agent and download this free guide that can walk you through all your selling options!

While new listings are still low, they are rising! If you are exploring the best timing to sell your home, we strongly recommend connecting with a local agent or investment firm! Our team of experts has several decades of combined experience in the San Diego housing market and eager to answer any of your questions about the market, your home value, and your selling options.

Selling with a cash investor

If your property is any of the following, a cash investor might be a great option for selling your home. If you fit any of the criteria below, you might want to consider selling to a San Diego cash investor. Here are some of the scenarios where it pays to sell your house in San Diego with a cash investor.

- Offload an unwanted rental

- Moving to assisted living

- Sudden relocation

- Retiring or downsizing

- Estate sales or inheritance

- Properties that need repairs

- Want to sell quick and avoid fees and paperwork